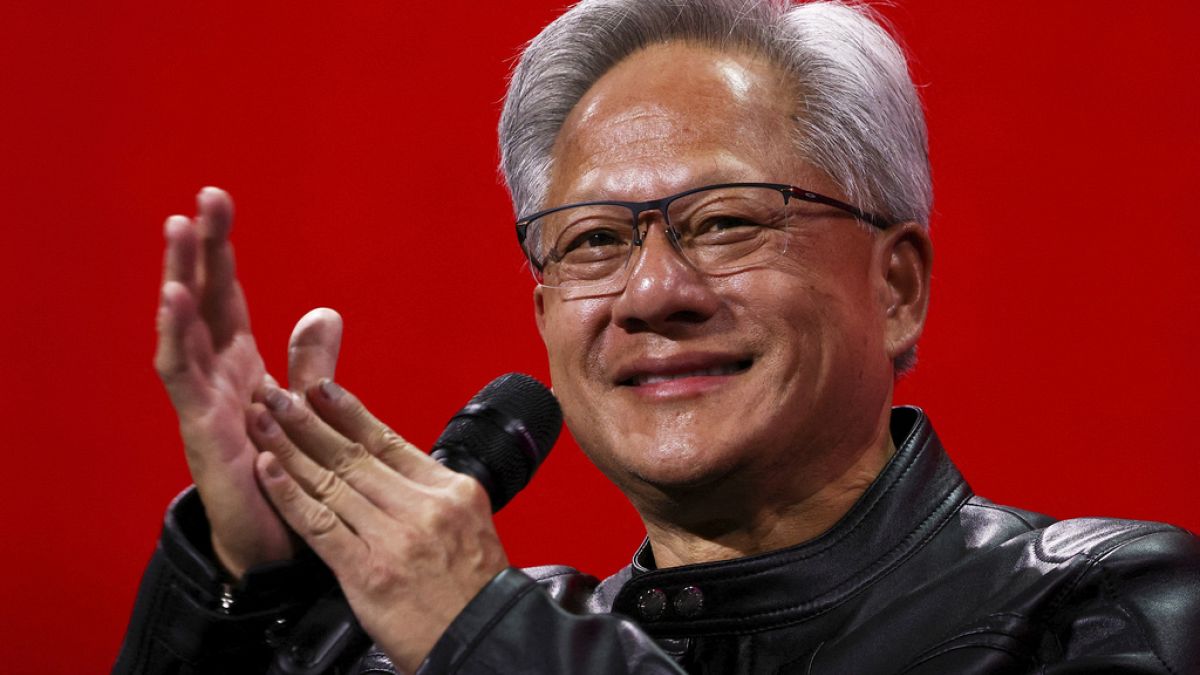

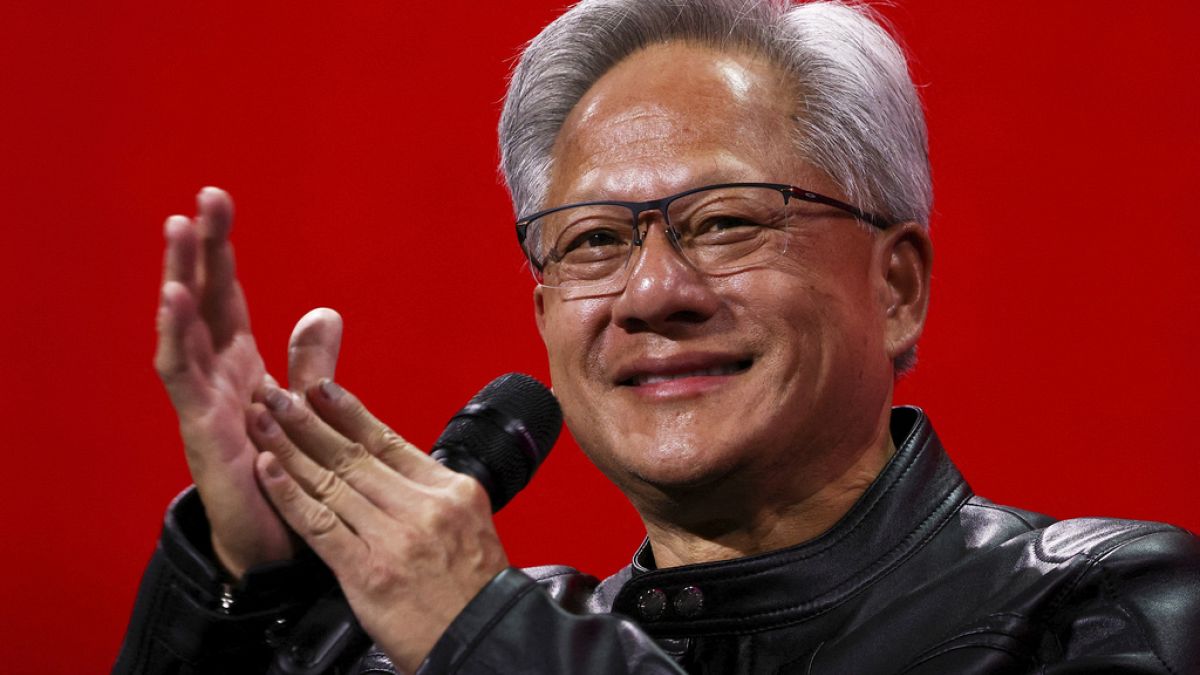

The landscape of global business and economic affairs presents a tapestry of rapid developments and interconnected shifts. At the forefront, Nvidia, the renowned technology company, has reached a historical milestone by becoming the first public company in the world to surpass a $4 trillion valuation. This achievement marks the pinnacle of a two-year period where investor enthusiasm has soared, reflecting the market’s confidence in Nvidia’s continued innovation and influence in the chipmaking industry.

Meanwhile, across the Atlantic, European companies are contending with the effects of a strong euro, which has seen a sharp rise in 2025. This currency fluctuation is placing significant pressure on corporate earnings, potentially leading to softer sales and tighter profit margins. As businesses prepare to report their second-quarter earnings, the dual challenge of a robust currency and waning demand presents a complex scenario that many are navigating with caution.

In parallel, the global trade environment is witnessing pivotal discussions that could reshape cross-border economic exchanges. German Chancellor’s optimistic remarks regarding an impending EU-US trade deal signal movement towards collaboration, even amidst ongoing negotiations to moderate substantial tariff rates that might have reached up to 50%. Instead, a more manageable 10% duty now seems more feasible, indicating progress toward a balanced agreement that could foster transatlantic trade cooperation.

However, the international trade landscape remains dynamic as the US administration, under President Trump, extends strategic tariffs discourse to multiple nations, creating a mix of anticipation and ambiguity among global markets. Letters dispatched to various countries outline significant trade agreements and proposals, although experts note that the communication from Washington reflects multifaceted policy directions that require careful interpretation by the global community.

Particularly notable is the rise in US copper prices following President Trump’s proposal of a 50% tariff on copper imports, aligning with existing duties on steel and aluminum. Such measures underscore the administration’s strategic stance on critical commodities while a potential further escalation with tariffs on pharmaceutical drugs up to 200% is also under consideration. These developments collectively indicate an evolving narrative in the realm of international trade, where strategic adjustments and negotiations continue to shape the global economic landscape.

As businesses, policymakers, and investors digest these changes, the interconnectedness of global economic affairs becomes ever more evident. The milestones and maneuvers witnessed this year remind us of the intricate balance required to maintain stability and growth in a world where technological advancements, currency dynamics, and trade policies intertwine to shape the future of the global economy.

Source: {link}