In a series of significant economic developments, several key financial activities and policy updates have emerged globally as we transition into the second half of 2025. These range from fiscal reforms in the United States to changes in corporate strategy in Europe, and notable mergers in the banking sector. Each in its way, these events are shaping the economic landscape, offering pathways and challenges alike for the global markets.

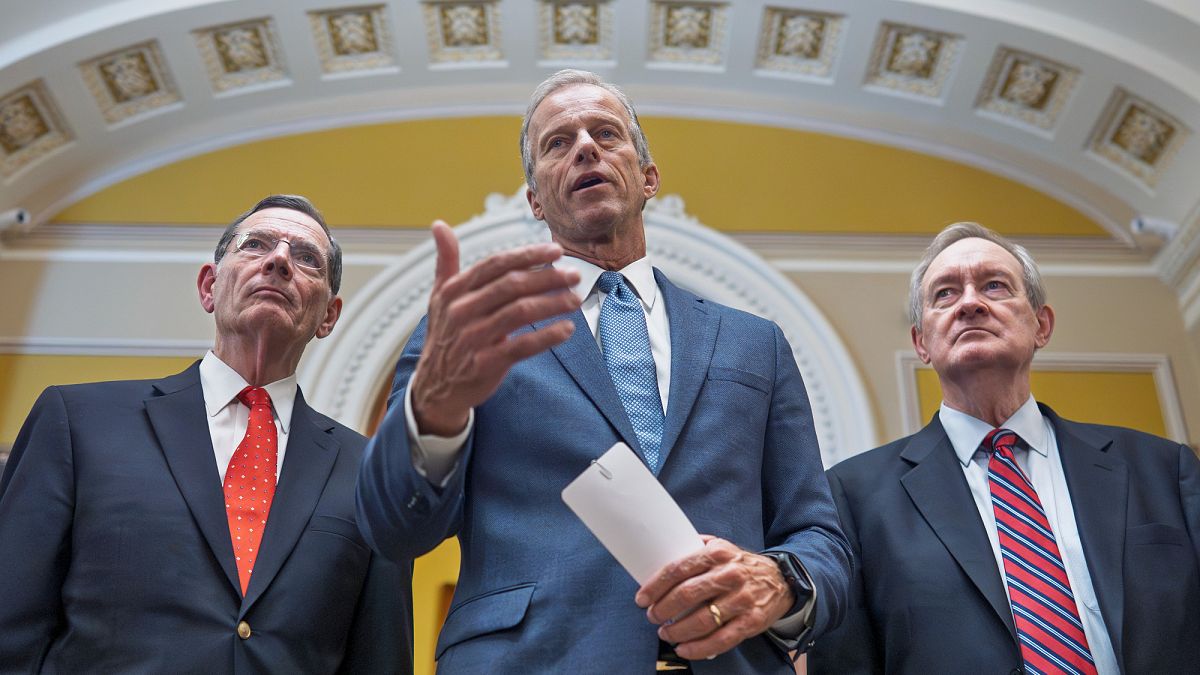

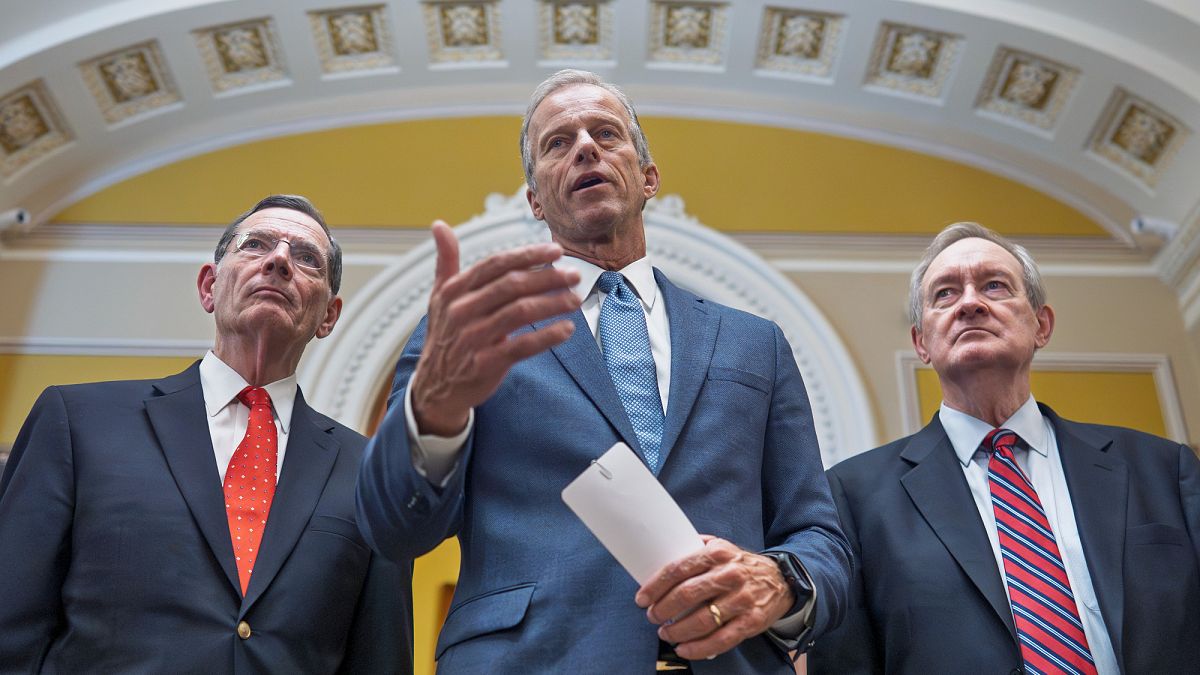

This week, the U.S. Senate took a pivotal step by passing a substantial tax reform package, initially proposed by former President Trump. Touted as a ‘big beautiful’ tax and cuts bill, this piece of legislation is now set to return to the House of Representatives. The Speaker, Mike Johnson, had expressly urged the Senate not to amend the chamber’s original approval. The bill marks a major milestone in the ongoing efforts to reshape fiscal policy within the United States, aiming to simplify tax codes while providing cuts that proponents believe will stimulate economic growth.

Across the Atlantic, in the automotive sector, Renault has reported a significant shift in its financial reporting due to a nearly €10 billion non-cash loss linked to its holdings in Nissan. This development comes as Renault alters its accounting practices regarding its long-term partnership with the Japanese automaker, influenced primarily by recent fluctuations in Nissan’s share price. The strategic decision underscores the intricate nature of international business relationships and their impact on corporate financial health.

Meanwhile, in the Eurozone, attention turns to monetary policy as inflation aligns with the European Central Bank’s (ECB) target for the first time in several years. Inflation rates reached 2% in June, a threshold that economists and policymakers have been monitoring closely. ECB President Christine Lagarde, speaking at the Central Bank’s symposium in Sintra, reaffirmed the institution’s commitment to ensuring price stability within the eurozone. Lagarde’s cautious yet determined stance emphasizes a continued focus on balancing growth with economic stability in the region.

In the banking sector, significant activity is underway with the announced acquisition of the British high street lender TSB by Spain’s Santander for £2.65 billion. This transaction marks the third major ownership change for TSB in over a decade, sparking concerns over potential job losses and branch closures. The acquisition is intricately linked to competitive pressures within Spain’s banking industry, particularly with Sabadell’s decision to sell TSB in response to a substantial €11 billion hostile bid from its rival, BBVA. These developments highlight the dynamic nature of the banking sector, with mergers and acquisitions playing a crucial role in shaping financial institutions’ strategies and operations.

Collectively, these economic insights underscore a period of transformation across various sectors. As stakeholders — from policymakers to corporate leaders — navigate these changes, the emphasis remains on fostering resilience and adaptability. In striving towards these objectives, the goal is to ensure sustained economic progress and stability in an ever-evolving global landscape. These individual accounts construct a broader picture of economic momentum, reflecting a society’s ongoing adaptation to both challenges and opportunities.

Source: {link}