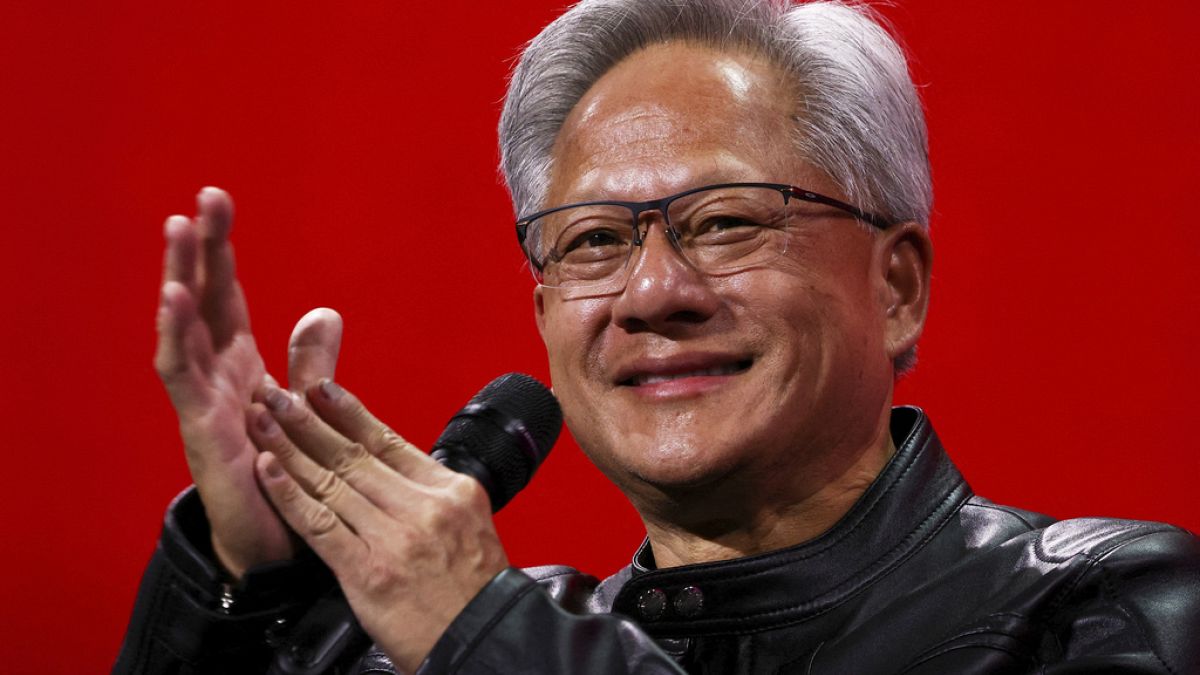

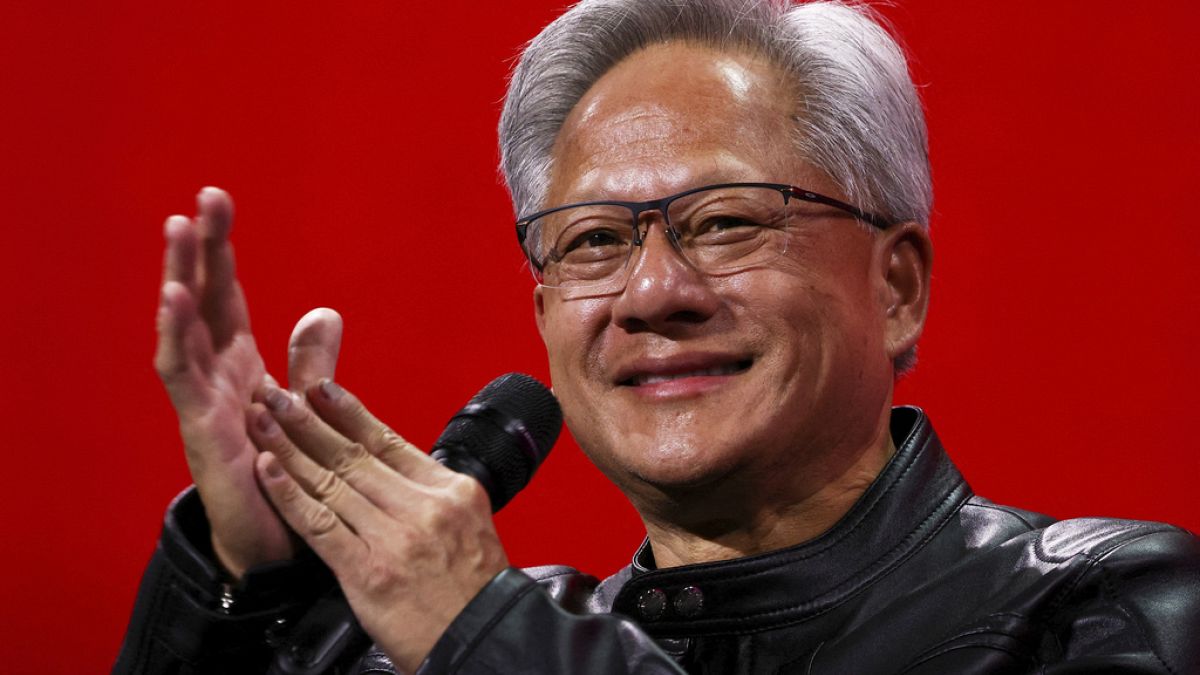

In a significant milestone, chipmaker Nvidia has reached historic heights by becoming the world’s most valuable company, attaining a valuation of $4 trillion. This remarkable achievement marks a peak for Nvidia, which has seen a surge of investor interest over the past two years. This ascent reflects Nvidia’s pivotal role in shaping the technological landscape, underscoring its influence as a leader in the semiconductor industry. The company’s innovation in graphics processing units and artificial intelligence hardware remains at the forefront of technology’s rapid evolution.

While Nvidia celebrates this milestone, broader economic factors continue to influence global markets. Economic dynamics in Europe highlight the complexities that companies face in a rapidly shifting environment. The euro has shown significant strength in 2025, which, while indicative of a robust currency, presents challenges for European companies. An elevated exchange rate can squeeze profit margins and adversely affect sales, particularly in sectors that heavily rely on exports. As second-quarter reports approach, companies brace for potential dips in earnings, signaling a cautious outlook amidst these fluctuations.

In the realm of international trade, the dialogue between the European Union and the United States remains pivotal. German Chancellor Olaf Scholz has expressed optimism regarding an impending EU-US trade deal. This agreement holds the potential to harmonize trade regulations and tariffs, offering a promising avenue for bolstering transatlantic economic ties. As both sides work diligently toward an agreement, the goal is to mitigate the imposition of steep tariffs, such as the looming 50% rate. Instead, a more measured 10% duty is being discussed, reflecting a collaborative spirit aimed at sustaining economic cooperation and mutual growth.

Meanwhile, in the Americas, former U.S. President Donald Trump has been vocal on the international stage, signaling potential tariffs in response to geopolitical dynamics. Following tensions surrounding the investigation of Brazil’s ex-leader Jair Bolsonaro, Trump has threatened to impose substantial tariffs on Brazilian imports. Denouncing what he terms a “Witch Hunt,” these remarks highlight ongoing complexity in U.S.-Brazil relations. Furthermore, Trump’s recent release of tariff letters addressed to the Philippines and other emerging economies underscores the broader implications of such trade policies. These tariffs, reminiscent of those announced on what was dubbed “Liberation Day” in April, signify a potential recalibration of economic relations with these nations.

As the global economic landscape continues to evolve, these developments are a reminder of the delicate balance required to navigate change. From Nvidia’s historic ascension, European currency dynamics, and transatlantic trade negotiations to the geopolitical tension marked by potential tariffs, the interconnected nature of the global economy remains both a challenge and an opportunity. Stakeholders and policymakers are tasked with navigating these waters mindfully, ensuring that economic policies foster stability and growth in a world of continuous economic transformation.

Source: {link}