In recent days, several impactful events have shaped the global economic and trade landscape, providing an intricate tapestry of growth opportunities and challenges for various sectors and regions. With calm and clarity, let’s explore these developments, capturing their essence and potential implications.

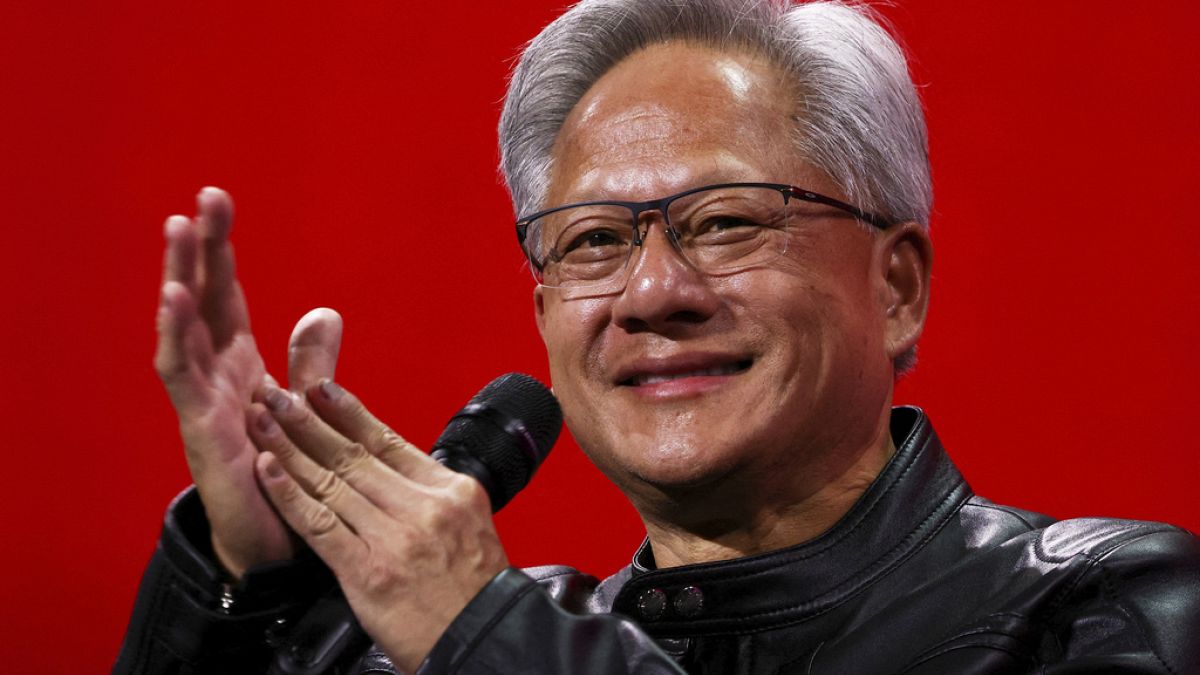

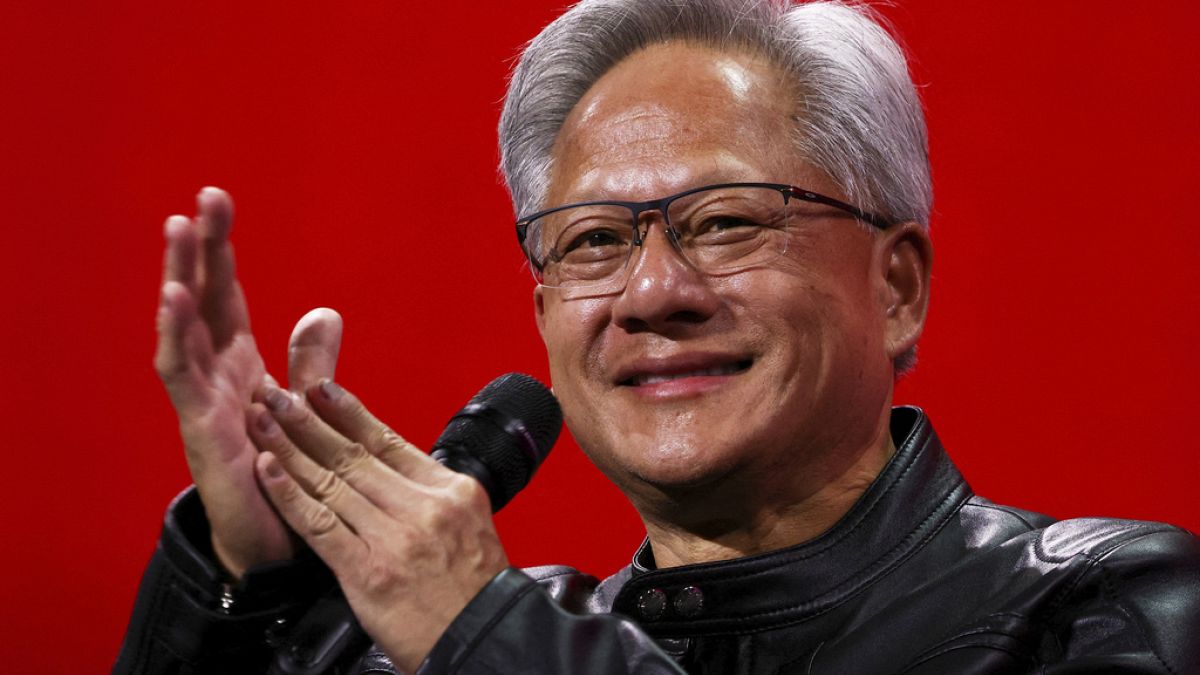

Starting on a note of remarkable achievement, Nvidia, the well-known chipmaker, has transcended its previous milestones to become the world’s most valuable company. The company achieved an unprecedented $4 trillion market value, a first for any public entity. This monumental rise followed a period of sustained investor enthusiasm, reflecting Nvidia’s strong position and influence in the technology sector, particularly driven by advancements in artificial intelligence and gaming hardware.

As we shift our attention to Europe, changes in currency dynamics present a nuanced picture for businesses. The euro has seen a significant appreciation in 2025, which, while indicative of a robust economic environment, poses challenges for European corporations. Analysts anticipate that this upward trajectory will put pressure on the profitability of companies in key sectors, potentially leading to lower earnings reports in the second quarter. Companies may experience reduced sales and profit margins due to a strong euro combined with a softening global demand. This situation is encouraging strategic adaptations to mitigate potential adverse effects.

On the international trade front, there is a positive momentum towards resolving tariff-related uncertainties between the European Union and the United States. German Chancellor Friedrich Merz has expressed a sense of cautious optimism about finalizing an EU-US trade agreement in the imminent future. Engaged in continuous dialogue with U.S. President Donald Trump and the European Commission, Merz aims to establish a solution that prevents high tariff rates from taking effect post-August 1st. The prospects of arriving at a mutual understanding have sparked positive expectations, potentially leading to a reduction in proposed tariffs from 50% to 10%.

Meanwhile, in Asia, China’s economic indicators reveal subtle movements toward inflation stabilization. For the first time since January, China’s inflation rate edged into positive territory in June, providing a glimpse of potential economic recovery. However, producer prices remain in deflation, underscoring varied challenges within the sector. This development aligns with broader efforts to spur economic growth and stability in the region’s marketplace.

These intertwined stories from around the globe highlight the dynamic nature of contemporary markets and international trade relationships. Each development brings with it opportunities to adapt, innovate, and engage cooperatively for a synergistic future. As companies and nations navigate these waters, they are reminded of the fragile balance between growth and sustainability, and of the potential inherent in choosing thoughtful and collaborative paths forward. The coming days and weeks promise further developments, as stakeholders endeavor to harness positive outcomes amid evolving economic landscapes.

Source: {link}