The global financial landscape witnessed notable developments recently, covering significant legislative, corporate, and economic updates. These events reflect the dynamic and interconnected nature of international finance and policy-making processes.

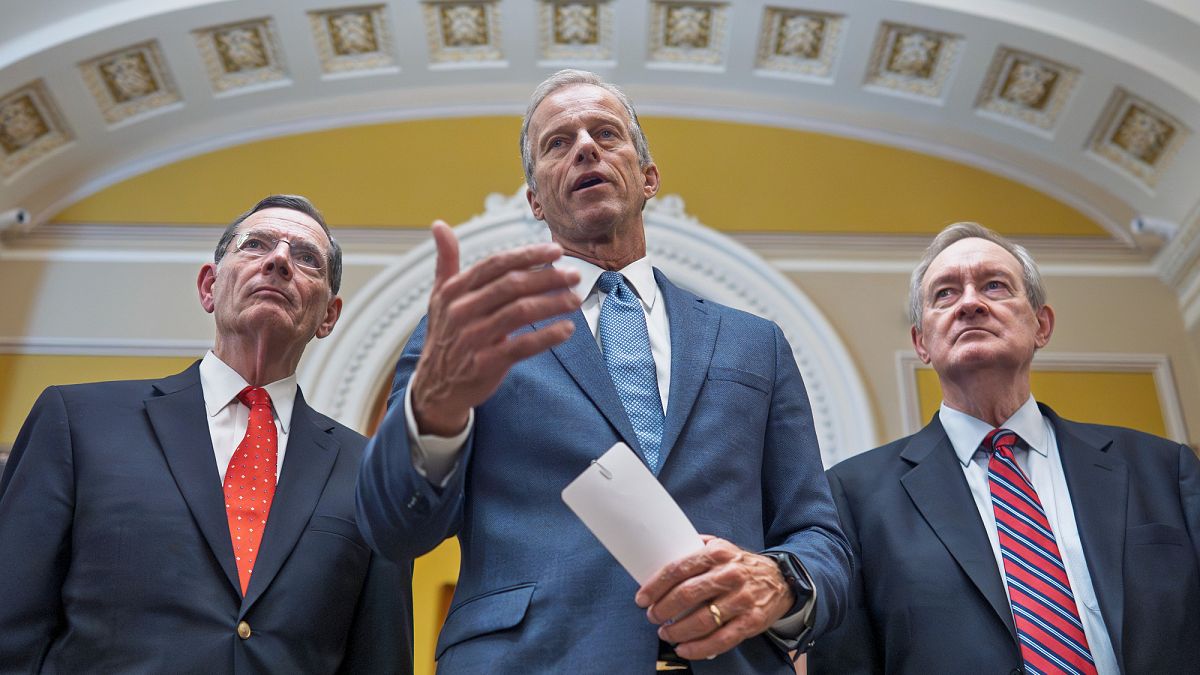

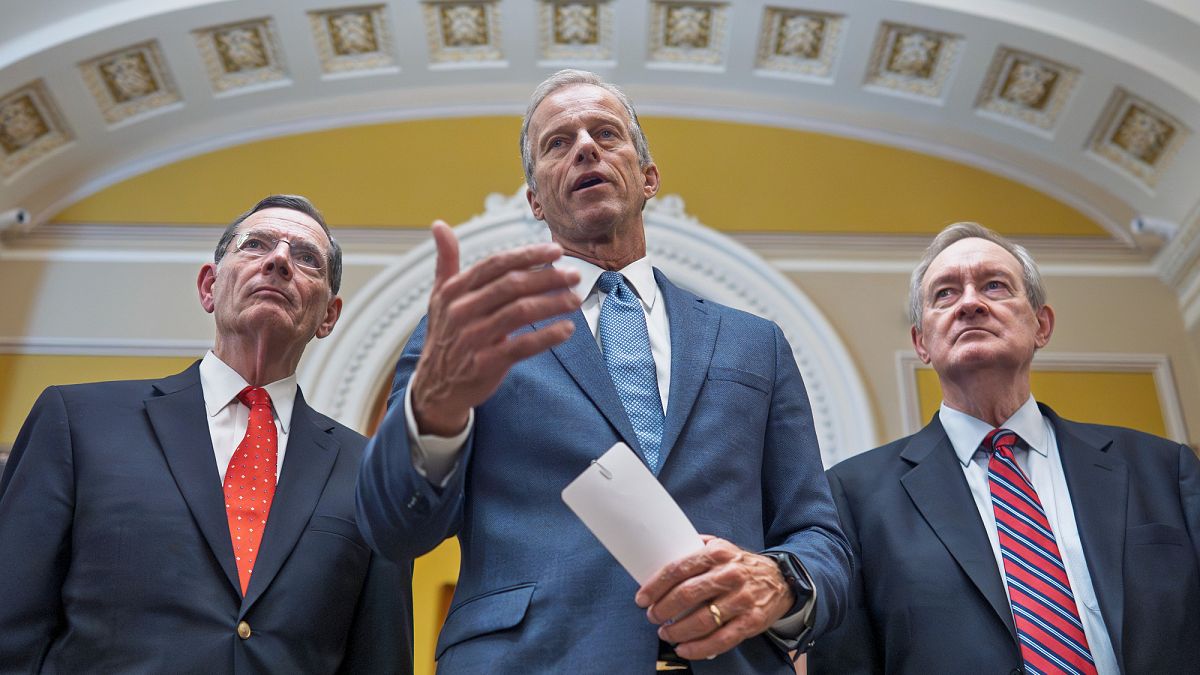

In the United States, a major political milestone was achieved with the Senate’s passage of an extensive tax reform bill. This legislative package is a comprehensive modification aimed at optimizing tax structures and fostering economic growth. The approval followed a night of intense deliberations reflecting the contentious nature of tax reforms. The bill now returns to the House, where Speaker Mike Johnson previously cautioned the Senate against making substantial alterations to the version already approved. This development underscores the complex negotiations and strategic dialogues that occur between the legislative chambers in shaping U.S. fiscal policy.

Across the Atlantic, the French automotive giant Renault is addressing financial challenges stemming from its long-standing partnership with Nissan. Renault reported a non-cash loss of nearly €10 billion, attributable to the valuation method of its stake in Nissan, influenced by the Japanese automaker’s share price movements. This significant loss has prompted Renault to reassess its accounting practices regarding its partnership with Nissan, reflecting the broader challenges multinational corporations face in navigating cross-border investments and financial reporting in the volatile global market.

Meanwhile, in the eurozone, economic indicators revealed a notable milestone, as inflation achieved the European Central Bank’s (ECB) target of 2% in June. ECB President Christine Lagarde expressed measured optimism while emphasizing the central bank’s vigilant stance at its annual symposium in Sintra. The ECB’s commitment to maintaining economic stability highlights the delicate balance central banks must strike in managing inflation targets while supporting robust economic activity.

In the banking sector, significant consolidation activities have been witnessed with Spanish banking giant Santander’s decision to acquire the British financial institution TSB for £2.65 billion. This acquisition marks the third major change in TSB’s ownership within the past twelve years, sparking concerns over potential branch closures and job redundancies. The purchase mirrors the broader trend of strategic acquisitions and mergers, driven by competitive pressures and market dynamics in the banking industry.

These developments in legislative actions, corporate financial strategic maneuvers, and banking industry consolidations underscore the multifaceted transformations underway in the global economic and financial landscape. As these narratives unfold, they provide a glimpse into the complexities and opportunities awaiting stakeholders across various sectors, reaffirming the interconnectedness of global markets and their impact on local and international scales.

Source: {link}